Loading

Get Monthly Value-added Tax 2550m

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

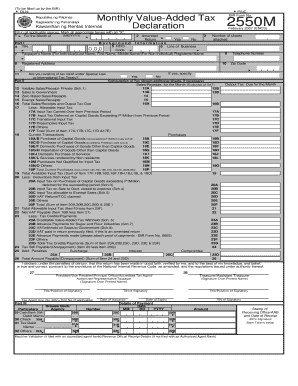

How to fill out the Monthly Value-Added Tax 2550M online

Filling out the Monthly Value-Added Tax (VAT) 2550M form online can seem complex, but this guide will walk you through each section. With clear instructions, you will be able to complete your form confidently and accurately.

Follow the steps to complete the form effectively.

- Press the ‘Get Form’ button to access the Monthly Value-Added Tax 2550M form and open it in your online editor.

- In the first section, provide the required information including your Taxpayer Identification Number (TIN), the month and year of the declaration, and your Registered Name or Taxpayer's Name. Make sure to indicate whether this is an amended return by checking 'Yes' or 'No'.

- Fill out the background information, including your Revenue District Office (RDO) code and registered address. Ensure your telephone number and zip code are also included.

- Continue to Part II, where you will compute tax. Record your sales/receipts for the month, categorized as vat-able, sales to government, zero-rated, and exempt sales. Tally the total sales and output tax due.

- Next, fill in the allowable input tax, specifying any input tax carried over from previous periods, deferred input tax, and other relevant categories. Calculate the total input tax available.

- Identify deductions from input tax, detailing any adjustments based on your purchases and their respective amounts.

- Calculate the net VAT payable or determine if there is an overpayment based on the input and output tax calculations.

- Sign the declaration, providing the title and TIN of the signatory. Ensure all entries are correct and complete before submitting.

- Finally, save changes, and download, print, or share the completed form as necessary.

Complete your Monthly Value-Added Tax 2550M form online today to stay compliant with tax regulations.

Under the Tax Reform for Acceleration and Inclusion (TRAIN) Law, VAT registered taxpayers are no longer required to file the Monthly VAT Declaration (BIR Form 2550M) but will instead file the corresponding Quarterly VAT Return (BIR Form 2550Q).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.