Loading

Get Sch S Supplemental Schedule Rev. 7-23. Sch S Supplemental Schedule To Be Filed With K-40

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Sch S Supplemental Schedule Rev. 7-23. Sch S Supplemental Schedule To Be Filed With K-40 online

Filling out the Sch S Supplemental Schedule is an essential step for taxpayers to accurately report their income modifications and deductions in Kansas. This guide provides comprehensive, step-by-step instructions to help users complete the form online with confidence.

Follow the steps to effectively complete the Sch S Supplemental Schedule.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

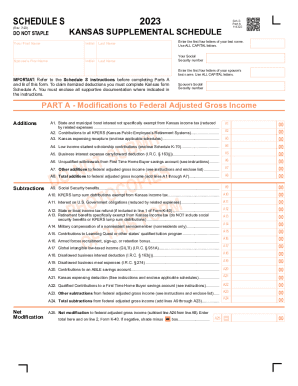

- Begin by filling out Part A of the form, which covers modifications to federal adjusted gross income. Enter your first name, last name, social security number, and the same for your spouse if applicable. Ensure you use all capital letters for the last name.

- For each line in Part A, follow the instructions carefully. Add any applicable additions by providing the requested information, such as state and municipal bond interest, contributions to KPERS, and other specified amounts.

- Continue to the subtraction section in Part A where you'll enter details for amounts like Social Security benefits or state tax refunds, ensuring you enclose any relevant schedules as instructed.

- Calculate the total additions (line A8) and total subtractions (line A24), then derive the net modification to federal adjusted gross income by subtracting line A24 from A8 and enter the result in line A25.

- Proceed to Part B if you are a nonresident or part-year resident. Document your total income from federal returns and any adjustments specific to Kansas sources, ensuring accuracy in reporting.

- In Part B, follow through with entries for various income types, including wages, pensions, and adjustments targeting Kansas source income. Make sure to shade any boxes for negative amounts as specified.

- Complete the income allocation percentage in line B23 by dividing the modified Kansas source income by the Kansas adjusted gross income, rounding to the fourth decimal place as needed.

- Review all entries for accuracy and completeness. Once confirmed, save your changes, download a copy for your records, print the form, or share it as necessary.

Complete your Sch S Supplemental Schedule online to ensure accurate filing and maximum deductions.

Write your SSN(s) on your check or money order and make payable to Kansas Individual Estimated Tax. Mail to: Estimated Tax, Kansas Department of Revenue, PO Box 3506, Topeka KS 66625-3506. Kansas 2022 - Individual Estimated Tax ksrevenue.gov https://.ksrevenue.gov › pdf › k-40es22 ksrevenue.gov https://.ksrevenue.gov › pdf › k-40es22

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.