Loading

Get Ks Dor Ks-1520 2023-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KS DoR KS-1520 online

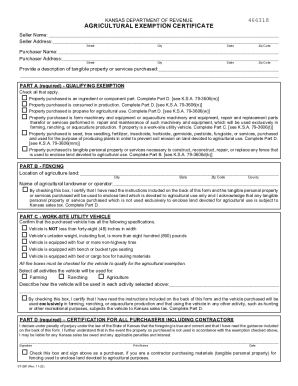

The KS DoR KS-1520 form serves as a crucial tool for businesses to utilize Kansas sales and use tax exemption certificates properly. This guide provides step-by-step instructions to assist users in completing the form effectively and ensures compliance with Kansas tax regulations.

Follow the steps to complete the KS DoR KS-1520 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Identify the type of exemption you are applying for and select the appropriate exemption category from the options provided on the form.

- Complete the purchaser's information section by providing your name, address, and the reason for exemption.

- Fill in the seller’s information, including their business name and address, ensuring that all details are accurate and complete.

- Describe the tangible personal property or services being purchased in detail to justify the exemption claimed.

- Verify that all required fields are filled out completely, including checking the applicable box for the exemption being claimed.

- Sign and date the form, confirming the accuracy of the information provided.

- Submit the completed form as indicated, and retain a copy for your records.

Complete your KS DoR KS-1520 form online today to ensure smooth processing of your sales tax exemption.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.