Loading

Get Form St-9 Single Location, Virginia Retail Sales And Use Tax Return. Virginia Retail Sales And Use

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form ST-9 Single Location, Virginia Retail Sales and Use Tax Return online

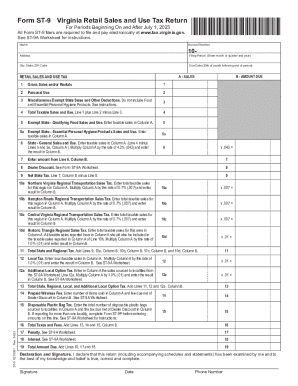

Filling out the Form ST-9, the Virginia Retail Sales and Use Tax Return, is essential for accurate tax reporting for retail sales and use tax. This guide provides detailed, step-by-step instructions to assist you in completing the form correctly and efficiently.

Follow the steps to successfully complete the Form ST-9

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your name and account number. Ensure that the information is accurate to avoid any processing issues.

- Provide your address, including city, state, and ZIP code, to specify your business location for tax purposes.

- Fill in the filing period, indicating the month or quarter and year for which you are filing the return.

- Record the due date, which is the 20th of the month following the end of the period. Ensure you adhere to this date to avoid penalties.

- Complete the sales information section. Start with gross sales and/or rentals in Line 1, followed by personal use and miscellaneous deductions.

- Calculate total taxable sales and use on Line 4, and report any exempt state qualifying food sales and sales of essential personal hygiene products.

- Determine the state general sales and use tax by calculating 4.3% on the taxable amount in Line 6.

- Add any applicable local, regional, and additional local option taxes as specified in Lines 10 and 12.

- Combine all tax calculations to find the total amount due on Line 19.

- Sign and date the declaration at the end of the form to verify the information provided is complete and accurate.

- Once completed, save, download, or print the form as needed, and submit it electronically as required.

Complete your Form ST-9 online for a seamless tax filing experience.

SALES AND USE TAX CERTIFICATE OF EXEMPTION The Virginia Retail Sales and Use Tax Act provides that the Virginia sales and use tax shall not apply to tangible personal property for use or consumption by this State, any political subdivision of this State, or the United States.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.