Get Form It-40, State Form 47907: County Tax Schedule (state ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form IT-40, State Form 47907: County Tax Schedule online

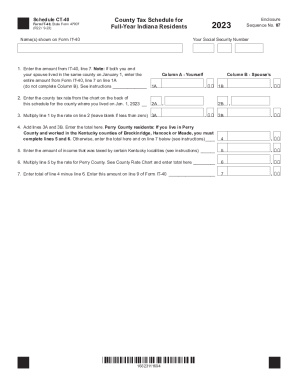

This guide provides a detailed overview of how to complete the Form IT-40, State Form 47907: County Tax Schedule for full-year Indiana residents online. By following these steps, you can ensure accurate reporting of your county tax information and compliance with state requirements.

Follow the steps to fill out the Form IT-40 online.

- Click the ‘Get Form’ button to obtain the form and open it in the designated editor.

- Enter the names as shown on Form IT-40 in the designated space at the top of the schedule.

- Input the amount from Form IT-40, line 7, in line 1A. If both you and your partner lived in the same county on January 1, enter the total amount from line 7 on line 1A and leave Column B blank.

- Look at the county tax rate chart on the back of the schedule and enter the appropriate tax rate for your county in line 2A.

- Multiply the amount entered on line 1A by the tax rate from line 2A and enter that figure in line 3A.

- If applicable, for Perry County residents who worked in certain Kentucky counties, you will need to complete lines 5 and 6. Otherwise, add the amounts from lines 3A and 3B and enter the total on line 4.

- If you are a Perry County resident and working in specified Kentucky areas, enter the amount of income taxed by those localities in line 5.

- Multiply the amount entered in line 5 by the rate for Perry County and record that total in line 6.

- Finally, subtract the amount on line 6 from the total on line 4 and enter this amount on line 7. This number should then be carried over to line 9 of Form IT-40.

- Review all entries for accuracy. You can then save your changes, download the completed form, print it, or share it as needed.

Complete your tax documents online with ease today.

The IRS 1040 form is one of the official documents that U.S. taxpayers use to file their annual income tax return. The 1040 form is divided into sections where you report your income and deductions to determine the amount of tax you owe or the refund you can expect to receive. What Is an IRS 1040 Form? - TurboTax Tax Tips & Videos - Intuit intuit.com https://turbotax.intuit.com › tax-tips › irs-tax-return › wh... intuit.com https://turbotax.intuit.com › tax-tips › irs-tax-return › wh...

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.