Loading

Get Nm Acd-31094 2023-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NM ACD-31094 online

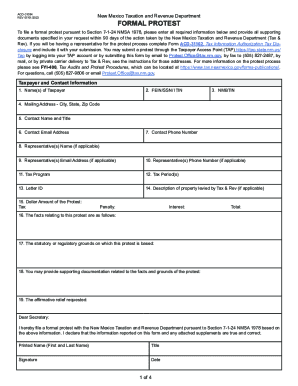

Filing a formal protest with the New Mexico Taxation and Revenue Department using form ACD-31094 is an essential process for taxpayers who wish to dispute decision outcomes. This guide provides you with detailed steps to complete the form effectively and accurately.

Follow the steps to successfully complete the NM ACD-31094 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your name(s) as the taxpayer. Ensure this matches the name on the assessment letter you are protesting.

- Provide your Federal Employer Identification Number (FEIN), Social Security Number (SSN), or Individual Taxpayer Identification Number (ITIN). If filing jointly, include both identification numbers.

- Input your New Mexico Business Tax Identification Number (NMBTIN) if applicable.

- Fill in your complete mailing address, including city, state, and zip code.

- Enter the full name and title of the contact person for this protest.

- Provide the contact email address you want to use for communication regarding this protest.

- Include the contact phone number, formatted with the area code.

- If you have a representative, provide their name, email address, and phone number. Remember to include Form ACD-31102 if applicable.

- Specify the tax program relevant to your protest, such as gross receipts tax.

- Indicate the specific tax period(s) relevant to this protest in the format mm/dd/yyyy.

- Enter the Letter ID from the tax notice if applicable, located at the top right corner of that document.

- If applicable, provide a description of the property levied by Tax & Rev.

- Detail the dollar amounts of the protest, including tax, penalty, interest, and the total amount being contested.

- Clearly outline the facts relating to your protest, including any supporting documentation.

- State the statutory or regulatory grounds for your protest.

- List any supporting documentation you are providing and summarize what they support.

- Outline the specific relief you are requesting from the Taxation and Revenue Department.

- Review all provided information, then sign and date the form. Ensure to include the title if submitted by a representative or business.

Complete your form and submit your protest online today to ensure your rights are protected.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.