Loading

Get 2023 Schedule Se (form 1040) (sp)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2023 Schedule SE (Form 1040) (sp) online

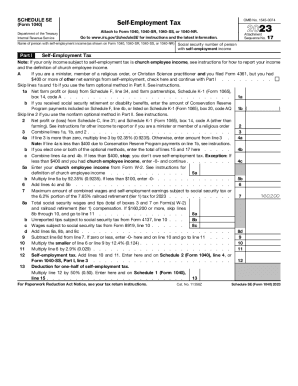

Filling out the 2023 Schedule SE (Form 1040) is essential for individuals with self-employment income. This guide provides clear, step-by-step instructions to successfully complete the form online and fulfill your tax obligations.

Follow the steps to fill out your form online effectively.

- Click ‘Get Form’ button to access the Schedule SE form and open it in your preferred document editor.

- Enter the name of the person with self-employment income as it appears on your Form 1040, 1040-SR, 1040-SS, or 1040-NR.

- Provide the social security number of the individual with self-employment income.

- In Part I, begin by reporting net farm profit or loss from Schedule F, line 34. If applicable, also include information from farm partnerships.

- If you have received church employee income, indicate this in the appropriate section. Ensure to follow any related instructions given for special cases.

- Add the amounts from lines 1a and 1b, and include net profit or loss from Schedule C as indicated on line 2.

- On line 4a, if line 3 is positive, multiply by 92.35%. If not, simply carry over the amount from line 3.

- Continue calculating the self-employment tax as instructed through to line 12, where you will sum specific lines to determine the total self-employment tax due.

- Calculate the deduction for one-half of the self-employment tax as outlined on line 13, completing all required fields for your calculations.

- Review the completed form for accuracy before finalizing.

- Once done, save your changes, download a copy, print it if needed, or share the form as required.

Complete your Schedule SE form online to stay compliant with tax regulations.

You may be eligible for a California Earned Income Tax Credit (CalEITC) up to $3,417 for tax year 2022 as a working family or individual earning up to $30,000 per year. You must claim the credit on the 2022 FTB 3514 form, California Earned Income Tax Credit, or if you e-file follow your software's instructions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.