Loading

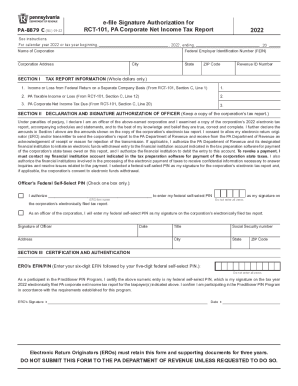

Get 2022 E-file Signature Authorization For Rct-101, Pa Corporate Net Income Tax Report (pa-8879 C)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the 2022 E-file Signature Authorization For RCT-101, PA Corporate Net Income Tax Report (PA-8879 C) online

Completing the 2022 E-file Signature Authorization For RCT-101 is essential for corporate officers to authorize electronic filing of the PA Corporate Net Income Tax Report. This guide provides clear, step-by-step instructions for filling out the form online to ensure compliance and accuracy.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in the calendar year and tax year fields with the appropriate dates in MMDDYYYY format. Ensure all entries are made in uppercase without using dashes or slashes.

- Enter the Federal Employer Identification Number (FEIN), name of the corporation, address, and Revenue ID Number in Section I, ensuring to follow the whole dollars only guideline.

- Complete the Tax Report Information section (Section I) by accurately entering the Income or Loss from Federal Return, PA Taxable Income or Loss, and PA Corporate Net Income Tax Due, using figures from the RCT-101.

- In Section II, declare the information by checking the relevant box to authorize the electronic return originator (ERO) to enter your federal self-select PIN or indicate that you will enter it yourself.

- Sign in the designated space as the officer of the corporation, ensuring to include the date in MMDDYYYY format along with your title and Social Security number.

- In Section III, the ERO must enter their EFIN and PIN. Both the officer and the ERO must then sign and date the form after printing it.

- After completing the form, save the changes, download the document, print it, or share it according to needs.

Complete the form and ensure timely submission of your documents online.

The RCT-101 report and all required attachments, including the reason the report cannot be e-filed, must be mailed to: PA Department of Revenue, Bureau of Corporation Taxes, P.O. Box 280704... Am I required to file corporation taxes with Pennsylvania?

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.