Loading

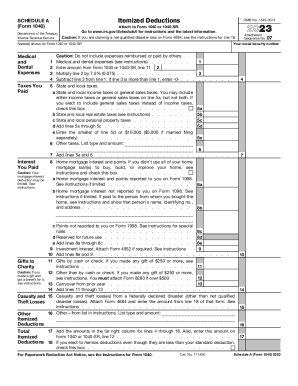

Get 2023 Schedule A (form 1040). Itemized Deductions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the 2023 Schedule A (Form 1040). Itemized Deductions online

The 2023 Schedule A (Form 1040) is designed for individuals seeking to itemize their deductions on their federal income tax returns. This guide offers a comprehensive overview of each section, providing clear instructions for effectively completing the form.

Follow the steps to complete your itemized deductions accurately.

- Click ‘Get Form’ button to obtain the Schedule A form and open it in the editor.

- Begin by entering your social security number at the top of the form. Next, include the name(s) as shown on your Form 1040 or 1040-SR.

- In the Medical and Dental Expenses section, list any qualifying expenses. Remember to include only the unreimbursed amounts and subtract 7.5% of your adjusted gross income from your total medical expenses.

- In the Taxes You Paid section, detail any state and local taxes, including income taxes or general sales taxes. Make sure to add these figures accurately.

- For Gifts to Charity, denote your contributions. If you made any gifts of $250 or more, be sure to refer to the instructions and include appropriate documentation.

- In the Interest You Paid section, provide information regarding any mortgage interest and points you are deducting. If applicable, consult the instructions for specific rules.

- If you incurred any Casualty and Theft Losses, especially from federally declared disasters, list the amounts accordingly and attach Form 4684.

- Review the Other Itemized Deductions field and list any other eligible deductions not already mentioned. This may include unreimbursed business expenses or other qualifying figures.

- Finally, sum up the amounts from the total deductions section and enter this total on your Form 1040 or 1040-SR. If you choose to itemize even if your deductions are less than the standard deduction, check the appropriate box.

- Once all sections are complete, ensure you save your changes, and consider downloading, printing, or sharing the form as needed.

Complete your Schedule A (Form 1040) itemized deductions online to accurately reflect your tax situation.

A taxpayer with significant eligible expenses which exceed the standard deduction will file a Schedule A. Eligible deductions may include qualified medical expenses, state and local taxes, mortgage interest, sales tax payments, and some charitable contributions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.