Loading

Get Form Ss-8 (rev. December 2023). Determination Of Worker Status For Purposes Of Federal Employment

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form SS-8 (Rev. December 2023). Determination of Worker Status for Purposes of Federal Employment online

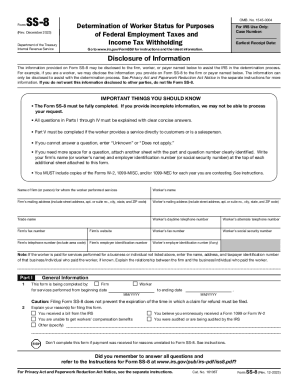

Form SS-8 is utilized to determine the status of a worker for federal employment tax purposes. This guide provides step-by-step instructions on how to accurately complete the form online.

Follow the steps to fill out the Form SS-8 online effectively.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Begin with Part I, where you need to provide general information. Indicate whether the form is being completed by the firm or the worker, and include the service period dates.

- Clarify the reason for filing Form SS-8. Choose from options like receiving an IRS bill or believing you incorrectly received a Form 1099 or W-2. Be specific.

- Indicate the total number of workers performing similar services and how the worker obtained the job, attaching any relevant advertisements.

- Attach all supporting documentation relevant to the worker’s status, such as contracts, invoices, and prior tax forms.

- Describe the nature of the firm’s business and provide relevant details about the worker’s job title and duties.

- Complete Part II, focusing on behavioral control aspects. Answer questions regarding training, assignment methods, and reports.

- Proceed to Part III to summarize financial control. List provided supplies and clarify any expenses incurred by the worker.

- Move to Part IV where you should define the relationship between the worker and the firm and note available benefits.

- For service providers or salespersons, complete Part V with details regarding customer interactions and sales responsibilities.

- Finally, ensure all fields are accurately filled, check for completeness, and submit the form. You can save changes, download, print, or share the completed form as needed.

Complete your Form SS-8 online today to ensure accurate determination of worker status.

The IRS will review the facts and circumstances and officially determine the worker's status. Be aware that it can take at least six months to get a determination. A business that continually hires the same types of workers to perform particular services may want to consider filing the Form SS-8PDF.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.