Loading

Get 2022 Form 8453-p California E-file Return Authorization For ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2022 Form 8453-P California E-file Return Authorization online

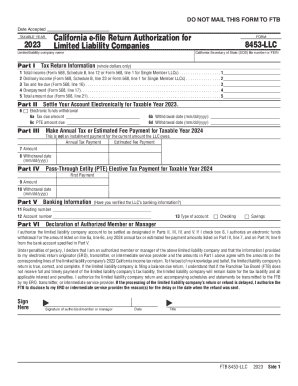

This guide provides a comprehensive overview of how to accurately complete the 2022 Form 8453-P for California e-file tax return authorization. Following these instructions will ensure users can efficiently navigate the form's components online.

Follow the steps to complete your e-file return authorization form.

- Click ‘Get Form’ button to obtain the form and open it in the designated editor.

- Enter the taxable year at the top of the form. Ensure that the year is listed as 2022.

- Provide the name of the limited liability company as it appears on official documents.

- Input either the California Secretary of State file number or the Federal Employer Identification Number (FEIN) associated with your limited liability company.

- Move to Part I and fill in the total income as reported on Form 568, Schedule B, line 12, or Form 568, line 1 if you are a Single Member LLC.

- Record the ordinary income as indicated on Form 568, Schedule B, line 23, or Form 568, line 1 for Single Member LLCs.

- Specify the tax and fee due by referring to Form 568, line 16.

- Note any overpayment listed on Form 568, line 17.

- Calculate the total amount due and enter this figure from Form 568, line 21.

- Proceed to Part II, indicating your preference for electronic funds withdrawal, by checking the appropriate box.

- Enter the tax due amount as well as the Pass-Through Entity (PTE) amount due, if applicable.

- Select the withdrawal dates for any payments that are applicable, formatted as mm/dd/yyyy.

- In Part V, confirm the banking information by providing the routing number and account number of the company's bank account.

- Indicate the type of account, choosing either checking or savings.

- In Part VI, ensure the authorized member or manager of the limited liability company signs the form and enters the date.

- Finally, review all provided information, save the changes, and proceed to download, print, or share the filled form as necessary.

To complete your tax filings accurately and efficiently, fill out all necessary documents online.

Taxpayers and Electronic Return Originators (EROs) use this form to send any required paper forms or supporting documentation listed next to the checkboxes on the front of the form. Form 8453 is used solely to transmit the forms listed on the front of the form. Do not send Forms W-2, W-2G, or 1099-R.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.