Loading

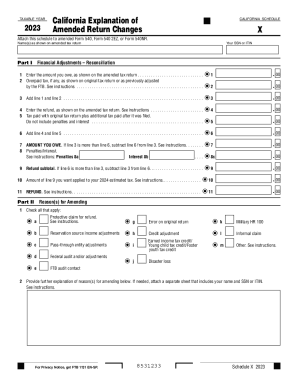

Get California Form 540-x (california Explanation Of Amended ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

In general, if a refund is expected on an amended return, taxpayers must file the return within three years of the due date of the original return, or within two years after the date they paid the tax, whichever is later. Amended And Prior Year Returns - IRS irs.gov https://apps.irs.gov › app › vita › content › globalmedia irs.gov https://apps.irs.gov › app › vita › content › globalmedia

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.