Loading

Get California Form 540-x (california Explanation Of Amended ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

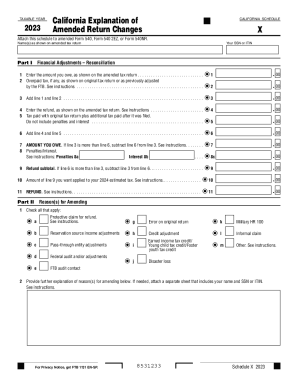

How to fill out the California Form 540-X (California Explanation Of Amended Return) online

Filling out the California Form 540-X is essential for individuals who need to amend their tax returns. This comprehensive guide provides step-by-step instructions to help you successfully complete the form online.

Follow the steps to complete the California Form 540-X online.

- Click ‘Get Form’ button to obtain the California Form 540-X and open it in your preferred online editor.

- Enter the tax year, which is 2023, at the top of the form.

- In the 'Name(s) as shown on amended tax return' section, input your full name(s) as listed in your original tax return.

- Fill in your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) in the corresponding field.

- For Part I, Financial Adjustments – Reconciliation, complete the fields indicating the amount owed and any overpaid tax from your original return.

- In lines 1 and 2, enter the amounts as instructed, and then add them together in line 3.

- Proceed to line 4 to enter the refund amount from the amended return and line 5 for total tax paid with your original return.

- Add line 4 and line 5 in line 6. Then determine the amount you owe or refund subtotal, filling in lines 7 to 11 as applicable.

- Move to Part II, select the reasons for amending by checking all that apply, and provide any necessary additional explanations.

- If additional space is needed for your explanations, attach a separate sheet including your name and SSN or ITIN.

- Review all entries to ensure accuracy, then save your changes, and download, print, or share the completed form as needed.

Start filling out your California Form 540-X online today to ensure your tax amendments are properly submitted.

In general, if a refund is expected on an amended return, taxpayers must file the return within three years of the due date of the original return, or within two years after the date they paid the tax, whichever is later. Amended And Prior Year Returns - IRS irs.gov https://apps.irs.gov › app › vita › content › globalmedia irs.gov https://apps.irs.gov › app › vita › content › globalmedia

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.