Loading

Get Ftb Form 3587fill Out And Use This Pdf

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Ftb Form 3587Fill Out And Use This PDF online

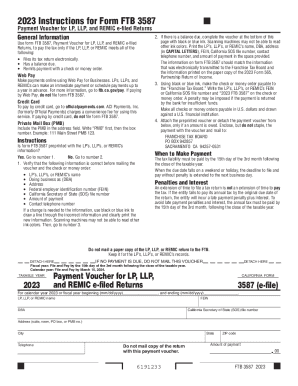

This guide provides a comprehensive overview of the Ftb Form 3587, a payment voucher for LP, LLP, and REMIC e-filed returns. Follow the step-by-step instructions to ensure accurate completion of the form.

Follow the steps to successfully complete the form online.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Verify if the form FTB 3587 is preprinted with your entity's information. If yes, confirm that the details such as your LP's, LLP's, or REMIC's name, DBA, address, FEIN, California SOS file number, payment amount, and contact number are accurate. If any details are incorrect, use black or blue ink to cross out the incorrect information and clearly print the new information.

- If the form is not preprinted with your information, fill in the voucher at the bottom of the form. Use black or blue ink to enter your LP's, LLP's, or REMIC's name, DBA, address (in capital letters), FEIN, California SOS file number, contact number, and the amount owed.

- Make your check or money order payable to the ‘Franchise Tax Board’ using black or blue ink. Ensure that you write your LP's, LLP's, or REMIC's FEIN or California SOS file number along with ‘2023 FTB 3587’ on the payment. Be cautious to avoid penalties by ensuring funds are sufficient.

- Attach the preprinted voucher or detach the payment voucher if you owe an amount. Enclose your payment but do not staple it to the voucher. Mail it to: FRANCHISE TAX BOARD, PO BOX 942857, SACRAMENTO CA 94257-0531.

- Make note of the payment due date, which is the 15th day of the 3rd month following the end of the taxable year. If the deadline falls on a weekend or holiday, it is extended to the next business day.

- Finally, save changes, download, print, or share the completed form as necessary once you have filled it out.

Complete your Ftb Form 3587 online today for a seamless filing experience.

Also, all LLCs and S Corps must pay a minimum franchise tax of $800 annually, except for the first year. Your business will be required to pay these taxes in advance four times per year in the form of estimated corporate taxes. For more details, check out the Instructions for Form 100-ES.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.