Loading

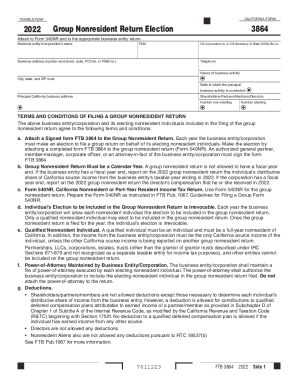

Get 2022 California Form 3864 Group Nonresident Return Election. 2022 California Form 3864 Group

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2022 California Form 3864 Group Nonresident Return Election online

This guide provides clear instructions on completing the 2022 California Form 3864 Group Nonresident Return Election, aimed at business entities and their electing nonresident individuals. Follow the outlined steps to ensure accurate and efficient filing.

Follow the steps to complete the form successfully.

- Press the ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Fill in the business entity’s or corporation's name at the top of the form. This information identifies the entity responsible for the group nonresident return.

- Enter the business entity’s federal employer identification number (FEIN) next to the name. This number is crucial for tax identification purposes.

- Provide the complete business address, including the number and street, suite, post office box, or private mailbox number.

- Include the California corporation number or the California Secretary of State (SOS) file number to verify registration in California.

- Enter a valid telephone number for the business entity or corporation, ensuring direct communication for any inquiries.

- Describe the nature of the business activity. This is essential for understanding the type of operations the business conducts.

- Fill in the city, state, and ZIP code for the business address to ensure accurate jurisdiction identification.

- Indicate the state where the principal business activity is conducted, which aligns with the taxation rules.

- Enter the principal California business address, if different from the previously provided address.

- Provide the number of non-electing individuals and the number of electing individuals participating in the group return.

- Familiarize yourself with the terms and conditions provided on the form. Confirm understanding and compliance before signing.

- Ensure an authorized individual signs the form, including their title and date of signing. This authorization is necessary to validate the election.

- After completing all sections, save your changes, download a copy for your records, and consider printing the form for physical documentation. Ensure you attach it to Form 540NR and any relevant business entity returns.

Complete your form online to ensure timely submission and compliance.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Generally, you must file an income tax return if you're a resident , part-year resident, or nonresident and: Are required to file a federal return. Receive income from a source in California. Have income above a certain amount.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.