Loading

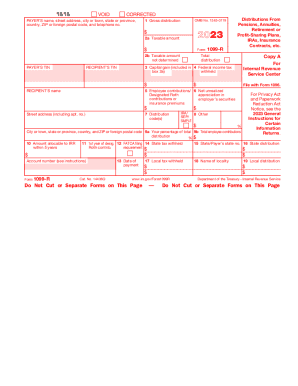

Get 2023 Form 1099-r. Distributions From Pensions, Annuities, Retirement Or Profit-sharing Plans, Iras

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2023 Form 1099-R. Distributions From Pensions, Annuities, Retirement Or Profit-Sharing Plans, IRAs online

Filling out the 2023 Form 1099-R is essential for reporting distributions from pensions, annuities, retirement plans, and other related accounts. This guide will provide you with clear, step-by-step instructions to navigate each section of the form and ensure you complete it correctly and efficiently.

Follow the steps to accurately fill out your form online.

- Press the ‘Get Form’ button to access the Form 1099-R and open it in your document editor.

- Enter the payer’s name, address, and telephone number in the designated fields. Ensure that the information is accurate to avoid any issues.

- In Box 1, input the total gross distribution amount you received during the year. This could include periodic payments or total distribution amounts.

- Fill in Box 2a with the taxable amount of the distribution. If the taxable amount is not known, check the appropriate box in Box 2b.

- If applicable, indicate any capital gains in Box 3 and the federal income tax withheld in Box 4.

- Complete Boxes 5 and 6 with details related to employee contributions and net unrealized appreciation.

- List the distribution code(s) in Box 7. This code helps clarify the type of distribution received.

- Fill out sections related to IRAs, SEP, and SIMPLE distributions in Box 8 and the percentage of the total distribution in Box 9a.

- Complete any additional boxes as needed, including date of payment, state tax withheld, and any local distribution information.

- Review the entire form for accuracy before saving your changes. You can download, print, or share the filled form as needed.

To ensure compliance and accuracy, fill out your documents online today.

Form 1099-R is used to report the distribution of retirement benefits such as pensions and annuities. You should receive a copy of Form 1099-R, or some variation, if you received a distribution of $10 or more from your retirement plan.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.