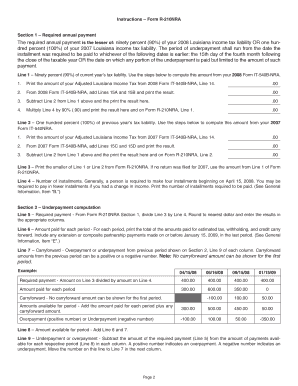

Get General Information A. Louisiana Imposes An Underpayment Penalty ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out and sign a form online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:The preparation of lawful paperwork can be costly and time-ingesting. However, with our predesigned online templates, everything gets simpler. Now, using a General Information A. Louisiana Imposes An Underpayment Penalty ... requires no more than 5 minutes. Our state-specific web-based blanks and simple guidelines eradicate human-prone errors.

Comply with our simple steps to have your General Information A. Louisiana Imposes An Underpayment Penalty ... well prepared rapidly:

- Choose the web sample in the library.

- Enter all necessary information in the necessary fillable areas. The intuitive drag&drop user interface allows you to add or move areas.

- Make sure everything is filled in correctly, without typos or absent blocks.

- Use your electronic signature to the page.

- Click on Done to save the alterations.

- Save the document or print out your copy.

- Submit instantly to the receiver.

Take advantage of the fast search and innovative cloud editor to generate a precise General Information A. Louisiana Imposes An Underpayment Penalty .... Clear away the routine and create paperwork on the web!

Estimated tax payment safe harbor details The IRS will not charge you an underpayment penalty if: You pay at least 90% of the tax you owe for the current year, or 100% of the tax you owed for the previous tax year, or. You owe less than $1,000 in tax after subtracting withholdings and credits.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.