Loading

Get 54 Nebraska Tax Application And Return - Revenue Ne

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 54 Nebraska Tax Application and Return - Revenue Ne online

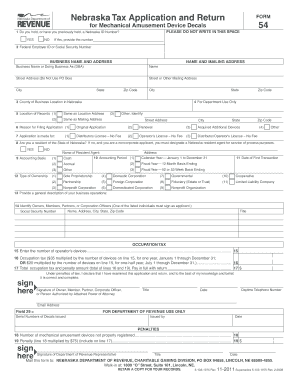

Completing the 54 Nebraska Tax Application and Return is essential for operators and distributors of mechanical amusement devices in Nebraska. This guide provides clear and step-by-step instructions to help users successfully fill out the form online.

Follow the steps to complete your Nebraska tax application online.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Indicate whether you hold or have previously held a Nebraska ID number by selecting 'Yes' or 'No'. If 'Yes', provide the ID number.

- Fill in your federal employer ID or social security number as required in the appropriate field.

- Enter your business name or doing business as (DBA) name, along with the street address (no PO Boxes), city, state, and zip code.

- Select the county where your business operates in Nebraska.

- Indicate the location of your records by selecting either 'Same as Location Address', 'Same as Mailing Address', or 'Other'. If 'Other', provide the necessary street address, city, and state.

- Select the reason for filing the application: 'Original Application' or 'Renewal'.

- Specify the type of application you are making: Distributors License, Operator’s License, or Distributor/Operator’s License.

- Indicate your residency status in Nebraska by selecting 'Yes' or 'No'. If 'No', provide the name and address of a Nebraska resident agent.

- Choose your accounting basis: Cash, Accrual, or other and specify the accounting period.

- Enter the date of your first transaction, choosing either 'Calendar Year' or 'Fiscal Year'.

- Select your type of ownership from the provided options, ensuring you complete the relevant information.

- Provide a general description of your business operations.

- Identify owners, members, partners, or corporation officers, and include their title, address, and social security number.

- Enter the number of mechanical amusement devices you operate.

- Calculate the occupation tax based on the number of devices, applying the appropriate rate for one year or half a year.

- Combine the total occupation tax with any penalties, if applicable, to determine your total amount due.

- Sign the form to declare that the information provided is accurate, also including your title, date, daytime telephone number, and email address.

- Review all the completed information, then save your changes, and utilize options to download, print, or share the form as needed.

Complete your Nebraska Tax Application online today for a streamlined filing experience.

For an exempt sale certificate to be fully completed, it must include: (1) identification of purchaser and seller; (2) a statement that the certificate is for a single purchase or is a blanket certificate covering future sales; (3) a statement of the basis for exemption, including the type of activity engaged in by the ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.