Loading

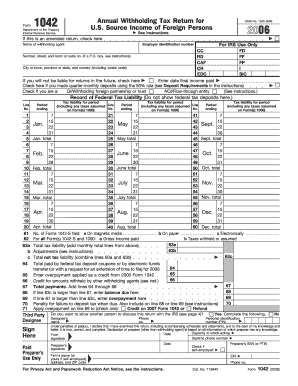

Get Source Income Of Foreign Persons See Instructions - Irs

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Source Income Of Foreign Persons See Instructions - Irs online

Filling out the Source Income Of Foreign Persons form is essential for reporting tax withheld on specified income of foreign individuals and entities. This guide will provide clear and straightforward steps to ensure accurate completion of the form online.

Follow the steps to fill out the Source Income Of Foreign Persons form effectively.

- Click the 'Get Form' button to obtain the form and open it in your editing environment.

- Complete the section for the name of the withholding agent. Ensure that you provide the correct name to accurately identify your role in the tax process.

- Enter your employer identification number (EIN). If you do not have one, you can apply for it through the appropriate channels detailed in the instructions.

- Fill in the address fields, including the number, street, room or suite number, city or town, province or state, and country, along with the postal code.

- Mark the applicable checkboxes if you are a withholding foreign partnership or trust, or if you have made quarter-monthly deposits using the 90% rule.

- Record federal tax liability information for the tax period, including amounts owed, and ensure all fields are filled out correctly without any negative amounts.

- Review and reconcile any amounts reported on Form 1042 with Form 1042-S to avoid discrepancies with the IRS.

- After completing all sections, ensure that you sign the form and include the date and any required information for a paid preparer, if applicable.

- Once you have reviewed the entire form for accuracy, proceed to save changes, and you may download, print, or share the form as needed.

Complete your documents online to streamline your tax reporting!

Use Form 1042 to report the following: The tax withheld under chapter 3 on certain income of foreign persons, including nonresident aliens, foreign partnerships, foreign corporations, foreign estates, and foreign trusts. The tax withheld under chapter 4 on withholdable payments.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.