Loading

Get Checklist For End Of Year For County Program Directors

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Checklist For End Of Year For County Program Directors online

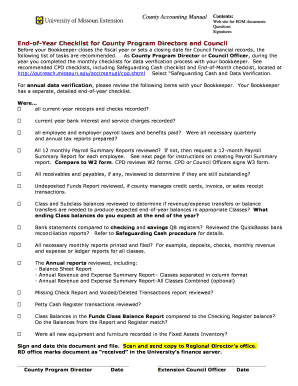

This guide provides straightforward instructions for County Program Directors on how to complete the Checklist For End Of Year online. By following these steps, users can ensure that all necessary tasks are completed accurately before closing the fiscal year.

Follow the steps to complete the checklist effectively.

- Press the ‘Get Form’ button to access the checklist in your preferred format.

- Review the list of tasks outlined on the form. Ensure that each task corresponds to the end-of-year requirements established for County Program Directors.

- Begin filling out the checklist by confirming that all current-year receipts and checks have been recorded as required.

- Next, verify that current year bank interest and service charges are accurately noted.

- Confirm that all payroll taxes and benefits for employees and employers have been paid and that the annual tax reports are prepared.

- Review the twelve monthly Payroll Summary Reports. If any are missing, request a summary report for each employee and compare with the W2 forms.

- Assess all receivables and payables to check for outstanding amounts.

- Examine the Undeposited Funds Report if your county manages credit card transactions or sales receipts.

- Evaluate Class and Subclass balances to determine necessary revenue or expense adjustments to meet end-of-year expectations.

- Cross-check bank statements with QuickBooks checking and savings registers, and review bank reconciliation reports.

- Print and file all necessary monthly reports, such as deposits and revenue and expense reports.

- Conduct a thorough review of the Annual reports, including the Balance Sheet Report and Revenue and Expense Summary Reports.

- Check the Missing Check Report and Voided/Deleted Transactions report for any discrepancies.

- Review all transactions recorded in the Petty Cash Register.

- Ensure that Class Balances from the Funds Class Balance Report match the Checking Register balance.

- Verify that all new equipment and furniture have been properly recorded in the Fixed Assets Inventory.

- Finally, sign and date the document, then scan and send a copy to the Regional Director’s office for processing.

Complete your end-of-year checklist online to ensure compliance with county program requirements.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.