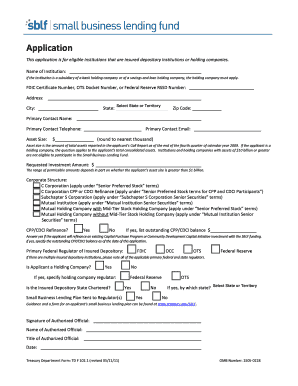

Get To Determine If Your Institution Is Eligible To Participate In The Small Business Lending Fund

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out and sign a form online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:Business, legal, tax and other electronic documents demand higher of compliance with the legislation and protection. Our forms are updated on a regular basis in accordance with the latest legislative changes. Additionally, with us, all the details you include in your To Determine If Your Institution Is Eligible To Participate In The Small Business Lending Fund is well-protected from loss or damage by means of top-notch file encryption.

The tips below can help you complete To Determine If Your Institution Is Eligible To Participate In The Small Business Lending Fund quickly and easily:

- Open the form in the feature-rich online editing tool by clicking on Get form.

- Fill in the necessary fields which are colored in yellow.

- Hit the green arrow with the inscription Next to move on from box to box.

- Go to the e-signature tool to add an electronic signature to the template.

- Insert the relevant date.

- Look through the entire template to ensure that you have not skipped anything important.

- Hit Done and download the resulting document.

Our service enables you to take the entire procedure of completing legal forms online. Consequently, you save hours (if not days or weeks) and eliminate extra costs. From now on, submit To Determine If Your Institution Is Eligible To Participate In The Small Business Lending Fund from your home, business office, or even on the go.

If you take out a small business term loan, you'll get a lump sum of capital that you'll pay back at a fixed interest rate with regular repayment terms. In most cases, these types of loans are repaid in five years and used to fund a specific investment for a small business.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.