Loading

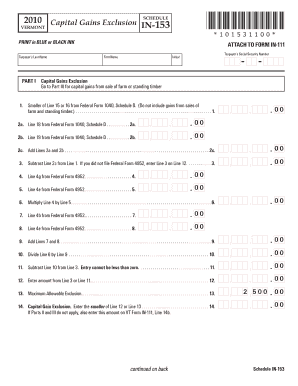

Get Enter The Smaller Of Line 12 Or Line 13 - Tax Vermont

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out and sign a form online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:Have you been looking for a quick and practical tool to fill in Enter The Smaller Of Line 12 Or Line 13 - Tax Vermont at a reasonable cost? Our service will provide you with a rich selection of forms that are available for completing on the internet. It takes only a couple of minutes.

Keep to these simple instructions to get Enter The Smaller Of Line 12 Or Line 13 - Tax Vermont prepared for submitting:

- Select the sample you will need in our collection of legal templates.

- Open the template in our online editor.

- Read the recommendations to discover which information you will need to give.

- Click the fillable fields and include the required details.

- Add the date and insert your e-autograph after you fill in all other boxes.

- Examine the completed document for misprints and other errors. In case there?s a need to change some information, the online editor along with its wide range of instruments are available for you.

- Download the new document to your gadget by clicking on Done.

- Send the electronic document to the intended recipient.

Filling in Enter The Smaller Of Line 12 Or Line 13 - Tax Vermont doesn?t need to be perplexing anymore. From now on comfortably cope with it from home or at your office straight from your mobile device or personal computer.

The personal income tax rate in Vermont is 3.35%–8.75%.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.