Loading

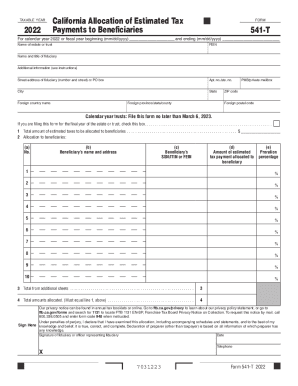

Get 2022 Form 541-t California Allocation Of Estimated Tax Payments To ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2022 Form 541-T California Allocation Of Estimated Tax Payments To Beneficiaries online

This guide provides a clear and supportive framework for completing the 2022 Form 541-T, which is used for allocating estimated tax payments to beneficiaries. By following the steps outlined in this guide, you can successfully fill out the form online with ease.

Follow the steps to complete your form accurately online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling out the title and taxable year section. Enter '2022' for the taxable year and include the calendar year or fiscal year dates as applicable.

- Provide the name of the estate or trust in the designated field along with the FEIN (Federal Employer Identification Number). Ensure this information is accurate.

- Fill out the name and title of the fiduciary, and include any additional information that may be required.

- Include the street address of the fiduciary, ensuring it’s complete with any apartment or suite number and city, state, and ZIP code details.

- Indicate if this form is being filed for the final year of the estate or trust by checking the appropriate box.

- In line 1, enter the total amount of estimated taxes to be allocated to beneficiaries.

- In the allocation to beneficiaries section, number each line starting with 1 and enter the beneficiary's name and address, their SSN/ITIN or FEIN, the amount of estimated tax payment allocated, and their proration percentage for each beneficiary.

- If there are additional beneficiaries, continue to fill out lines accordingly and reference additional sheets if necessary.

- Ensure that the total amounts allocated in line 4 equal the amount you entered in line 1. This is crucial for accuracy.

- Sign and date the form where indicated, verifying that the information provided is true and correct to the best of your knowledge.

- Review the completed form for accuracy and completeness before proceeding.

- Save changes, download, print, or share the form as necessary to complete your filing requirements.

Start filling out your 2022 Form 541-T online today to ensure timely and accurate tax allocation.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

In addition, California law currently allows an exclusion from gross income for grants received from several COVID-19 grant programs, including grant amounts awarded as a SVOG under the CAA, for taxable years beginning on or after January 1, 2019, and grant amounts awarded as a RRG under the ARPA for taxable years ...

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.