Loading

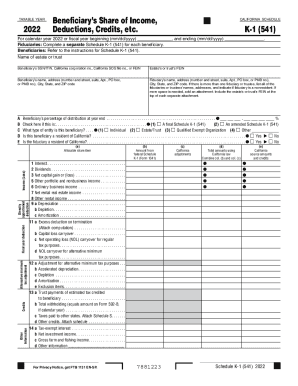

Get 2022 Schedule K-1 (541) - Beneficiary's Share Of Income, Deductions, Credits, Etc.. 2022 Schedule

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2022 Schedule K-1 (541) - Beneficiary's Share Of Income, Deductions, Credits, Etc. online

Filling out the 2022 Schedule K-1 (541) is crucial for beneficiaries to report their share of income, deductions, and credits from a trust or estate. This guide provides a detailed, step-by-step approach to help users navigate the form effectively and ensure compliance.

Follow the steps to successfully complete your Schedule K-1 (541) online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the taxable year at the top of the form, selecting '2022' or inputting the relevant fiscal year dates in the designated fields.

- Fill in the name of the estate or trust in the appropriate section, ensuring correct spelling and formatting.

- Provide the beneficiary’s Social Security Number (SSN), Individual Taxpayer Identification Number (ITIN), or other identifying number as required.

- Complete the beneficiary's name and address fields with accurate information, ensuring to include the city, state, and ZIP code.

- List the fiduciary’s name and address, noting if there are multiple fiduciaries, and ensuring all required information is included.

- Indicate the beneficiary’s percentage of distribution at year-end, using numerical format for percentage.

- Check the appropriate box to indicate if the Schedule K-1 (541) is amended or final.

- Select the entity type for the beneficiary by checking the correct box: Individual, Estate/Trust, Qualified Exempt Organization, or Other.

- Specify whether the beneficiary and fiduciary are residents of California by checking 'Yes' or 'No'.

- Complete the income and deduction sections, providing amounts as listed, such as interest, dividends, and net capital gains.

- If applicable, fill out any necessary California adjustments, tax credits, and other relevant information.

- Review the completed form for accuracy, making sure all fields are filled out correctly before proceeding.

- Save the changes made to the form, and proceed to download, print, or share it based on your needs.

Start completing your Schedule K-1 (541) online today to ensure timely and accurate filing.

Schedule K-1 is a tax document that you might receive if you are the beneficiary of a trust or estate. This document reports a beneficiary's share of income, deductions and credits from the trust or estate.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.