Loading

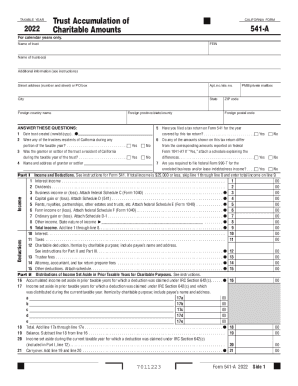

Get 2022 California Form 541-a Trust Accumulation Of Charitable Amounts. 2022 California Form 541-a

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2022 California Form 541-A Trust Accumulation Of Charitable Amounts online

This guide provides clear and systematic instructions for completing the 2022 California Form 541-A, designed for Trust Accumulation of Charitable Amounts. By following these steps, you will ensure accurate and timely submission of the form, allowing for efficient management of your charitable trust.

Follow the steps to complete the form correctly.

- Press the ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Enter the name of the trust and the Federal Employer Identification Number (FEIN) in the designated fields at the top of the form.

- Fill in the name of the trustee(s) along with their address, including street address or P.O. box, city, state, and zip code.

- Provide the date the trust was created in the mm/dd/yyyy format.

- Indicate whether any of the trustees were residents of California during the taxable year by selecting 'Yes' or 'No'.

- Answer whether the grantor or settlor was a resident of California during the taxable year, again by selecting 'Yes' or 'No'.

- Fill out the next section regarding if a tax return was filed on Form 541 for the year covered by this tax return by selecting 'Yes' or 'No'.

- Complete the income section, including reporting interest income, dividends, and any business income. Make sure to attach relevant schedules as necessary.

- Move to deductions, ensuring to itemize expenses such as trustee fees, attorney fees, and any other deductions you intend to claim.

- Complete Part II and Part III regarding distributions for charitable purposes. Itemize the details as required, including the purpose and amounts.

- If necessary, fill out the balance sheets in Part IV, detailing assets and liabilities of the trust. Ensure to present a complete view of the trust’s financial status.

- Finally, sign and date the form. If applicable, include the preparer’s information and check if they can discuss the return with the Franchise Tax Board.

- Once you have filled out all the sections with accurate information, you can save changes, download, print, or share the completed form.

Complete your 2022 California Form 541-A online today for smooth processing.

The fiduciary (or one of the fiduciaries) must file Form 541 for a trust if any of the following apply: Gross income for the taxable year of more than $10,000 (regardless of the amount of net income) Net income for the taxable year of more than $100. An alternative minimum tax liability.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.