Loading

Get 2023 Form 1096

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

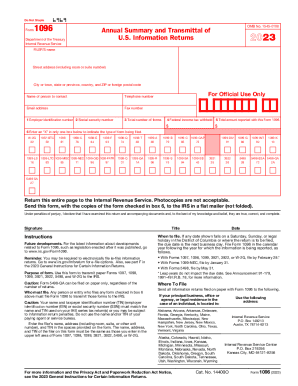

How to fill out the 2023 Form 1096 online

Filling out the 2023 Form 1096 accurately is essential for transmitting your information returns to the IRS. This guide provides clear, step-by-step instructions to help you complete the form online with confidence.

Follow the steps to successfully complete your Form 1096.

- Click the ‘Get Form’ button to access the form and open it in your editor.

- Enter your name in the 'FILER'S name' section as it appears on your tax documents. Be sure to include your full street address, including any room or suite numbers.

- Fill in the 'City or town, state or province, country, and ZIP or foreign postal code' section accurately to ensure proper processing.

- Provide the name of a contact person, along with their telephone number, email address, and fax number if applicable.

- In the 'Employer identification number' box, enter your EIN, and if relevant, enter your SSN in the following box.

- Specify the total number of information returns you are transmitting with this Form 1096. Exclude any blank or voided forms.

- If applicable, input the total federal income tax withheld shown on the accompanying forms in the designated box.

- Enter the total amount reported with this Form 1096 in the appropriate field.

- In Box 6, mark an 'X' in only one box to indicate the type of form being filed. Make sure to carefully select the correct form from the list provided.

- Review all entered information for accuracy. Once confirmed, proceed to save your changes, download the completed form, or print it out for submission.

Start filling out your Form 1096 online today to ensure timely and accurate submission!

On November 21st, the IRS announced that the 1099-K filing threshold will remain at 20,000 USD and 200 transactions for tax year 2023.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.