Loading

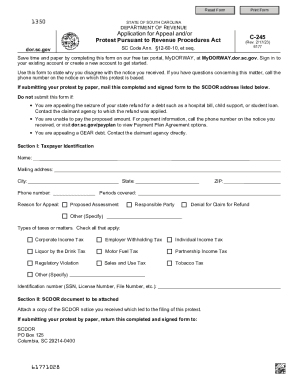

Get South Carolina Form C 245

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the South Carolina Form C 245 online

Filling out the South Carolina Form C 245 online can streamline the process of appealing a tax assessment. This guide provides clear and supportive steps to help users navigate the form, ensuring that all necessary information is accurately submitted.

Follow the steps to successfully complete your appeal and/or protest.

- Click ‘Get Form’ button to access the form in the online editor.

- In Section I, provide your taxpayer identification details, including your name, mailing address, city, state, phone number, and ZIP code. Clearly state your reason for the appeal and the periods covered by the proposed assessment.

- Indicate the type of tax or matter you are protesting by checking all relevant options in the form, such as corporate income tax or sales and use tax. Enter your identification number, which could be your Social Security Number, license number, or file number.

- In Section II, attach a copy of the SCDOR notice that prompted your protest. Ensure that you have this document ready before submission.

- Proceed to Section III to clearly articulate the reasons for your protest. Include supporting facts and any relevant laws or authorities that substantiate your position. If necessary, add additional sheets for more information.

- Review Section IV, where all required signatures must be collected. If applicable, ensure that both taxpayers sign if it's a joint income tax return, or that the corporate officer's name and title are included for corporations.

- Finally, save your changes, and choose to download, print, or share the completed form as needed for your records or submission.

Complete your documents online today for a more efficient filing experience.

If you are a nonresident or part-year resident, you are generally required to file a South Carolina return if you work in South Carolina or are receiving income from rental property, businesses, or other investments in South Carolina. Individual Income Tax returns are due April 15 of each year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.