Loading

Get Wh 1612

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WH-1612 online

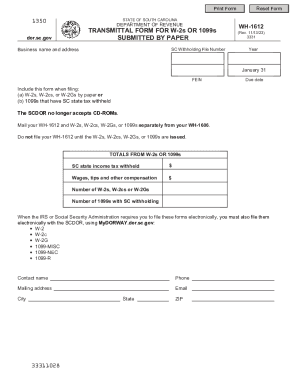

Filling out the WH-1612 form accurately is crucial for ensuring compliance with South Carolina tax withholding regulations. This guide provides clear, step-by-step instructions to help users navigate the process of completing the form online.

Follow the steps to fill out the WH-1612 form correctly

- Click ‘Get Form’ button to access the WH-1612 form and open it for editing.

- Enter the year for which you are filing in the designated field.

- Provide the business name and address, ensuring all information is accurate and complete.

- Input the SC Withholding File Number if applicable, or note that it can be omitted by preparers.

- Enter your Federal Employer Identification Number (FEIN) in the corresponding field.

- Fill in the total amount of South Carolina state income tax withheld, calculated from your W-2s or 1099s.

- Record the total wages, tips, and other compensation as required.

- Indicate the number of W-2s, W-2cs, or W-2Gs submitted by paper.

- Specify the number of forms in the federal Form 1099 series with South Carolina withholding, also submitted by paper.

- Complete the demographic information including contact name, phone number, mailing address, email, city, state, and ZIP code.

- Review all entries for accuracy and completeness before finalizing.

- Once completed, save changes, download the form, print it, or share it as needed.

Complete your WH-1612 form online to ensure compliance with tax regulations.

An employee who is a resident of NC is subject to NC withholding on all of his wages, whether he works in NC or in another state. EXCEPTION: NC withholding is not required if the other state in which the employee works requires the employer to withhold income for that state.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.