Get St 389

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the St 389 online

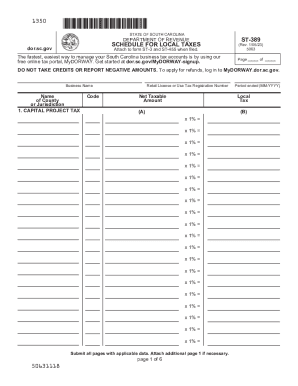

The St 389 form is an essential document for reporting local taxes in South Carolina. This guide provides step-by-step instructions on how to accurately fill out this form online, ensuring that you meet all necessary tax obligations.

Follow the steps to accurately complete your St 389 form online.

- Click ‘Get Form’ button to access the St 389 form and open it in the online editor.

- Enter your business name in the designated field at the top of the form.

- Select the name of the county or jurisdiction where your business operates.

- Provide your Retail License or Use Tax Registration Number in the specified section.

- For each type of tax, such as Capital Project Tax, School District Tax, and others, fill out the net taxable amount in Column A and calculate the local tax in Column B based on the provided rates.

- Ensure that for entries related to the Local Option Tax, you use the specific city or town code rather than the general county code.

- If more space is required to list all applicable local taxes, attach additional pages as needed and ensure to complete all relevant sections.

- Review all entries for accuracy before proceeding to the summary section, where you will enter the totals of Column A and B.

- Complete the ST-389 Worksheet if applicable, ensuring deductions and net sales are recorded correctly.

- Once all necessary information is complete, save changes, download your form, or print it for submission.

Fill out your St 389 form online today to stay compliant with local tax requirements.

5% What is the Casual Excise Tax rate and how is it calculated? The tax rate is 5% of the fair market value of the airplane, motor, or boat purchased. Fair market value is defined as: 1. the total purchase price (price agreed upon by the buyer and seller) minus any trade-in allowance of the boat, motor, or airplane; or 2. Form ST-236 - SC Department of Revenue sc.gov https://dor.sc.gov › forms-site › Forms sc.gov https://dor.sc.gov › forms-site › Forms

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.