Loading

Get Llc Filing As A Corporation Or Partnership

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the LLC Filing As A Corporation Or Partnership online

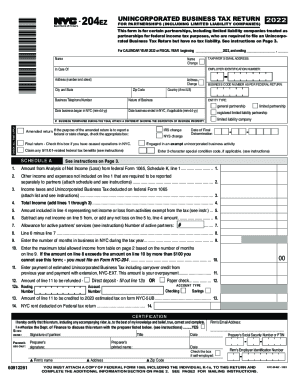

Filing your LLC as a corporation or partnership is an important step in ensuring compliance with tax obligations. This guide will assist you in completing the necessary form online with confidence, showcasing a clear process for users of all experience levels.

Follow the steps to fill out the form efficiently.

- Press the ‘Get Form’ button to access the LLC Filing As A Corporation Or Partnership form and open it in an editable format.

- Enter your name, any changes, and a contact email address in the designated fields. Be sure to clearly indicate your Employer Identification Number, as well as your complete address, including city, state, and zip code.

- Provide your business telephone number and describe the nature of your business. Include the date your business began operations in New York City and, if applicable, the date it ended.

- Select your entity type by checking the appropriate box, which should correspond to either a general partnership, limited partnership, registered limited liability partnership, or limited liability company.

- If your business has terminated during the year, attach a statement showing the disposition of business property as instructed.

- Complete Schedule A by entering required values including the net income or loss from federal Form 1065 and other related income not included in line 1, ensuring you also account for any deductions.

- Review and certify the information provided by signing in the designated area. Include the preparer's signature and contact information if applicable.

- Attach a copy of federal Form 1065, including the individual K-1s, to ensure a comprehensive submission. Don't forget to include any additional information required on Page 2.

- Finally, you can save your changes, download the filled-out form, print it for your records, or share it as needed before submission.

Complete your LLC filing online today to ensure compliance and streamline your business operations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Specifically, a domestic LLC with at least two members is classified as a partnership for federal income tax purposes unless it files Form 8832 and affirmatively elects to be treated as a corporation.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.