Loading

Get Do Not Apply To Increases In Assessed Value Due To Physical

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Do Not Apply To Increases In Assessed Value Due To Physical online

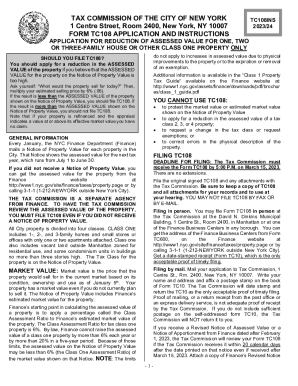

This guide provides a clear, step-by-step approach for filling out the Do Not Apply To Increases In Assessed Value Due To Physical form (TC108) online. Whether you are new to this process or have previous experience, this document aims to simplify the application procedure for you.

Follow the steps to successfully complete the TC108 form.

- Click ‘Get Form’ button to obtain the TC108 form and open it in the editor.

- Begin by filling out Section 1, which includes the property identification details such as block number, lot number, and full address of the property. This information can be found on your Notice of Property Value.

- In Section 2, provide information about the Applicant. Ensure that the person or entity listed is directly affected by the assessment, like the owner or a tenant paying the property taxes.

- Fill out Section 3 with the contact information of the individual or firm that the Tax Commission should reach out to regarding this application.

- In Section 4, input your estimate of the MARKET VALUE of your property. Calculate this figure based on the price you believe the property would sell for in the current market.

- Complete Section 5 by selecting your preference for a hearing — whether you wish to have an in-person hearing, a telephone hearing, a video conference, or to have the application reviewed based on submitted papers.

- Proceed to Section 6 and provide details about the property's physical description as of January 5, 2023. Include information such as the number of kitchens, baths, and any physical alterations since your acquisition of the property.

- In Section 7, indicate if any part of the property was rented for nonresidential use in the last year. If so, additional forms must be filed.

- In Section 8, report any construction, refinancing, or alterations made to the property since January 5, 2021. Attach relevant documents as needed.

- Fill out Section 9 if you checked the box for submitting supporting information about your market value estimate. Provide details about any comparable sales as evidence.

- Lastly, in Section 10, ensure that the form is signed by the appropriate individual with personal knowledge of the facts. The application must be certified for accuracy.

- After completing the form, save the changes, and choose to download, print, or share the TC108 as necessary.

Complete your TC108 application online today for a streamlined experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Appraised value, though, is the amount a professional home appraiser thinks your home is worth; it's typically used by lenders when considering a mortgage application. Typically, appraised values are higher than assessed values.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.