Loading

Get Ptax 329

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ptax 329 online

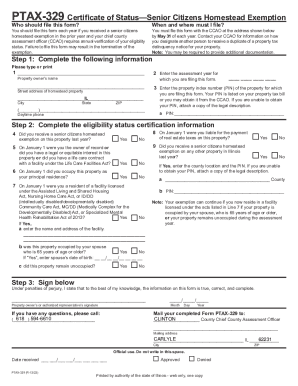

The Ptax 329 is a vital form for individuals who have received a senior citizens homestead exemption in the previous year. This guide provides step-by-step instructions to help you complete the form accurately and submit it online, ensuring you maintain your exemption status.

Follow the steps to fill out the Ptax 329 online successfully.

- Click ‘Get Form’ button to access the Ptax 329 and open it in your editing tool.

- Complete the required information in Step 1. Begin by entering your personal details, including the property owner's name, the assessment year for filing, and the property index number (PIN). If you cannot find the PIN, you may need to include a legal description of the property.

- Move to Step 2, where you will confirm your eligibility status. Answer the series of questions regarding your senior citizens homestead exemption eligibility, including if you received the exemption last year, if you were liable for property taxes on January 1, and if you occupied the property as your primary residence.

- In Step 3, sign the form under penalties of perjury, indicating your understanding that the information provided is true and complete. Include your signature, and the appropriate date of signing.

- Finally, once the form is completely filled out, you can save your changes, download, print, or share the document as necessary.

Submit your Ptax 329 online today to ensure your continued eligibility for the senior citizens homestead exemption.

A Person with Disabilities Exemption is for persons with disabilities and provides an annual $2,000 reduction in the equalized assessed value (EAV) of the property.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.