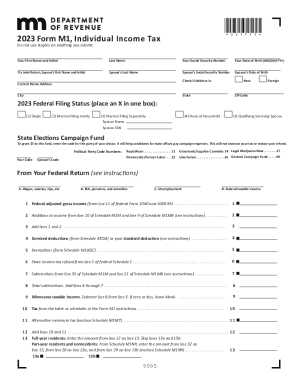

Get 2023 Form M1, Individual Income Tax Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out and sign a form online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:Experience all the benefits of completing and submitting documents online. With our platform completing 2023 Form M1, Individual Income Tax Return only takes a few minutes. We make that possible through giving you access to our feature-rich editor effective at altering/correcting a document?s original textual content, adding unique fields, and putting your signature on.

Complete 2023 Form M1, Individual Income Tax Return in several moments by following the instructions listed below:

- Find the document template you need from the library of legal forms.

- Choose the Get form button to open it and begin editing.

- Fill in the necessary boxes (they are marked in yellow).

- The Signature Wizard will allow you to insert your e-autograph after you?ve finished imputing info.

- Put the date.

- Check the whole document to make sure you have completed all the information and no changes are required.

- Press Done and download the resulting form to the computer.

Send your 2023 Form M1, Individual Income Tax Return in a digital form when you finish completing it. Your data is securely protected, because we adhere to the most up-to-date security standards. Join numerous happy clients who are already filling out legal documents straight from their houses.

File a Minnesota income tax return if you moved into or out of Minnesota in 2023 and your 2023 Minnesota source income is $13,825 or more. Complete Schedule M1NR, Nonresidents/Part-Year Residents, to determine income received while a Minnesota resident and income received from Minnesota sources while a nonresident.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.