Loading

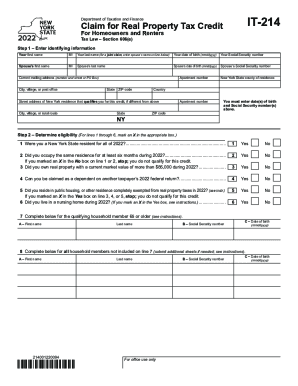

Get Form It-214 Claim For Real Property Tax Credit For Homeowners And Renters Tax Year 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form IT-214 Claim For Real Property Tax Credit For Homeowners And Renters Tax Year 2022 online

Filing the Form IT-214 is an important step for homeowners and renters seeking to claim real property tax credits in New York. Completing this form accurately ensures that you are considered for potential tax benefits. This guide will walk you through the online process of filling out the form with clear, step-by-step instructions.

Follow the steps to complete the form correctly.

- Click the ‘Get Form’ button to access the form and open it in your preferred online editor.

- Begin by entering your identifying information, including your first name, middle initial, last name, date of birth, Social Security number, and similar details for your spouse if applicable. Ensure all information is accurate, as it is crucial for verifying eligibility.

- Determine your eligibility by answering questions 1 through 6. Mark an 'X' in the appropriate box for each question regarding residency, property ownership, and other factors that impact your eligibility. If you answer 'no' to any key question, review the instructions for further guidance.

- Compute your household gross income in step 3, summarizing all income received by you and your household members in 2022. This includes wages, Social Security payments, pensions, and other income sources. If your total exceeds the limit, you will not qualify for the credit.

- In step 4, compute the real property tax. For renters, record the total rent paid and any adjustments based on utilities and other factors. For homeowners, list real property taxes paid and any special assessments. Ensure that all calculations are accurately completed.

- Move to step 5 to compute the credit amount. Depending on your rental or property tax figures from the previous steps, calculate the amount you may be eligible to claim. Be mindful of the specified limits and conditions that could affect your credit.

- Finally, enter your account information for direct deposit if applicable, sign the form, and include any required identification numbers. Review all entered information for accuracy before finalizing.

- Save any changes made, then download, print, or share the completed form as necessary for submission along with your New York State income tax return or separately by mail.

Start filling out your tax credit claim form online today to take advantage of available benefits!

New York State household credit full- or part-year resident. married or head of household with a federal adjusted gross income (FAGI) of $32,000 or less (allowed for married filing separate) single with an FAGI of $28,000 or less.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.