Loading

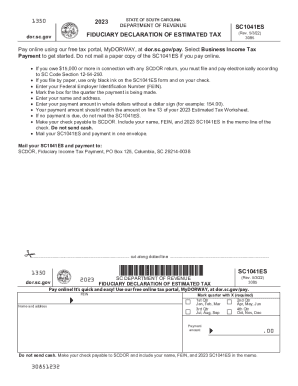

Get Sc1041es Fiduciary Income Tax Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC1041ES Fiduciary Income Tax Return online

Filling out the SC1041ES Fiduciary Income Tax Return online is a straightforward process. This guide will provide you with step-by-step instructions to ensure that all necessary information is accurately recorded and submitted without confusion.

Follow the steps to complete the SC1041ES form online.

- Click ‘Get Form’ button to obtain the SC1041ES form and access it in your preferred digital format.

- Begin by entering your Federal Employer Identification Number (FEIN) in the designated field.

- Provide your name and address in the appropriate sections, ensuring accuracy for mailing purposes.

- Select the appropriate quarter for which the payment is being made by marking the corresponding box.

- Enter the payment amount in whole dollars without using a dollar sign, making sure it aligns with the amount calculated on line 13 of the 2023 Estimated Tax Worksheet.

- If you are making a payment, ensure to follow the guidelines, such as making the check payable to SCDOR and including your name, FEIN, and 2023 SC1041ES in the memo line.

- Review all the provided information for accuracy before finalizing your submission.

- Once completed, save the changes to your form, and choose to download, print, or share the SC1041ES as needed.

Start filling out the SC1041ES form online today to ensure timely and accurate tax submissions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.