Loading

Get Sc3911.pdf - Sc Department Of Revenue - Sc.gov

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the SC3911.pdf - SC Department Of Revenue - SC.GOV online

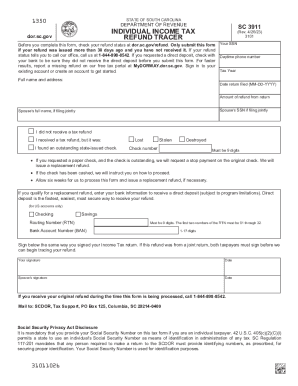

Filling out the SC3911 form, also known as the Individual Income Tax Refund Tracer, is a key step if you have not received your tax refund in a timely manner. This guide provides clear instructions on how to effectively complete the form online, ensuring that all necessary information is accurately submitted.

Follow the steps to complete the SC3911 form online.

- Press the ‘Get Form’ button to download the SC3911 form and open it in your preferred editor.

- Begin by entering your Social Security Number (SSN) in the designated field. This number is essential for identification purposes as mandated by state regulations.

- Provide your daytime phone number so that the Department of Revenue can contact you if needed during the process.

- Fill in the tax year for which you are inquiring about your refund. Make sure to specify the correct year to avoid processing delays.

- Complete the full name and address section. Ensure that the information matches what is on your tax return.

- Indicate the date your tax return was filed using the MM-DD-YYYY format.

- Enter the amount of the refund you expected from your return, as this information is necessary for tracing your refund.

- If applicable, fill in your spouse's SSN and full name if you are filing jointly.

- Select the appropriate option regarding the status of your tax refund: if you did not receive it or if you received it but it was lost, stolen, or destroyed. Provide the check number if it applies.

- If you qualify for a replacement refund, enter your bank information for direct deposit, including the routing number and account number.

- Sign the form in accordance with how you signed your original Income Tax return. If filing jointly, your spouse must also sign.

- Finally, save your changes, and consider downloading or printing a copy of the completed form for your records before submitting it.

- Mail the completed form to the address specified on the document.

Complete your documents online today for a smoother filing experience.

If you qualify for a paper copy of a tax form based on these criteria, you can email your paper form request to forms@dor.sc.gov or call 1-844-898-8542 to speak to a representative. You will need to provide your name, address, and the form you are requesting.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.