Get Ia Ia 1041 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IA IA 1041 online

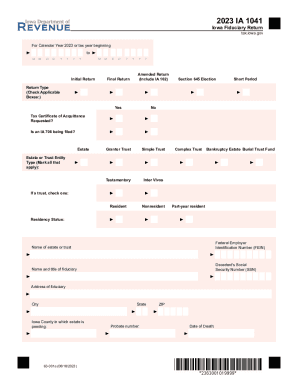

This guide provides clear, step-by-step instructions on how to accurately fill out the IA IA 1041 form online. Designed for individuals and entities navigating fiduciary tax returns, it simplifies the process to ensure a successful filing.

Follow the steps to complete your IA IA 1041 form online.

- Press the ‘Get Form’ button to access and open the IA IA 1041 form in your browser. Make sure your internet connection is stable for a seamless experience.

- Begin by filling in the basic details such as the tax year and whether the return is an initial, amended, or final return. Check the applicable boxes to indicate the return type.

- Provide details regarding the estate or trust entity type by marking all applicable categories including grantor trust, simple trust, complex trust, or other relevant options.

- Input the federal employer identification number (FEIN) and the name of the estate or trust. Also, include the decedent’s social security number as required.

- Fill in the name and address of the fiduciary responsible for this return, along with their contact information, including phone number and email.

- Navigate to the income and deductions section. Enter the amounts for various types of income including interest income, ordinary dividends, business income, capital gains, and other relevant financial data.

- Complete the deductions section by listing applicable deductions for taxes, fees, and other expenses associated with managing the estate or trust.

- Calculate the total taxable income and applicable credits or taxes due as outlined on the form.

- Review all entered information for accuracy, ensuring that no section is left incomplete or contains errors.

- Once satisfied, save the form using the ‘Save’ option or download it for your records. You can choose to print it or share it via email if required.

Take the first step in managing your fiduciary responsibilities by filling out your IA IA 1041 form online today.

IRS extra standard deduction for older adults For 2023, the additional standard deduction is $1,850 if you are single or file as head of household. If you're married, filing jointly or separately, the extra standard deduction amount is $1,500 per qualifying individual. The Extra Standard Deduction for People Age 65 and Older - Kiplinger kiplinger.com https://.kiplinger.com › taxes › extra-standard-dedu... kiplinger.com https://.kiplinger.com › taxes › extra-standard-dedu...

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.