Loading

Get Form Rp-420-a/b-rnw-1 Renewal Application For Real Property Tax ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form RP-420-a/b-Rnw-1 Renewal Application For Real Property Tax online

Filling out the Form RP-420-a/b-Rnw-1 Renewal Application for real property tax exemption can be straightforward when you follow the right steps. This guide provides clear instructions to help you complete each section of the form online.

Follow the steps to successfully complete your application.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

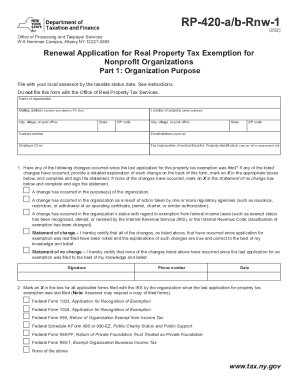

- Begin with Part 1: Organization Purpose. Enter the name of the organization, the property location, and the mailing address, including the city or village, state, and ZIP code.

- Provide a contact number and an optional email address for any correspondence.

- Fill in the employer identification number and the tax map number of the section/block/lot. This information can usually be found in your tax bill or assessment roll.

- Indicate if any changes have occurred since the last application. If applicable, check the relevant boxes and provide detailed explanations on the back of the form. Otherwise, check the Statement of no change box and complete the certification.

- In the second section, mark an X next to all applicable forms filed with the IRS since the last application. This may include various federal forms such as Form 1023 or Form 990.

- If there are changes to explain, attach additional sheets as necessary, ensuring to include the organization's name, employer identification number, and parcel number on each attachment.

- Ensure to fill out the final certification section with your signature, phone number, and the date.

- After completing the form, review all entries for accuracy. Save any changes made to the document, then download, print, or share the completed application as needed.

Complete your renewal application online for the Form RP-420-a/b-Rnw-1 today.

A wide range of nonprofits may qualify for a full or partial exemption, including charitable organizations, hospitals, educational institutions, houses of worship, religious organizations, parsonages, historical societies, libraries, public playgrounds, cemeteries, veterans groups, and more.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.