Get Annual Return (4567) - Department Of Treasury - Formalu

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Annual Return (4567) - Department Of Treasury - Formalu online

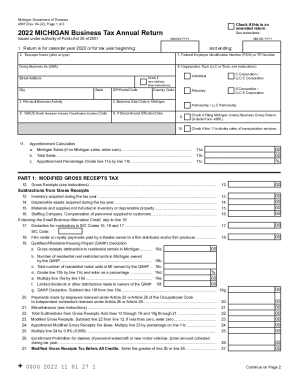

This guide provides an expert analysis of the Annual Return (4567) form issued by the Michigan Department of Treasury. It offers detailed, step-by-step instructions to help users fill out the form accurately and efficiently, ensuring compliance with tax requirements.

Follow the steps to complete the Annual Return form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the applicable tax year in MM-DD-YYYY format at the designated area. This should correspond to the year you are filing the return for, which is typically the previous calendar year.

- In the Taxpayer Name section, print or type the full name as registered with the Michigan Department of Treasury. This name should match your legal business name.

- Provide your Federal Employer Identification Number (FEIN) or Treasury (TR) Number in the specified fields. This number is crucial for identifying your business record.

- If doing business under a different name, fill out the Doing Business As (DBA) section accurately.

- Complete the Organization Type by checking the appropriate box that represents your business structure (e.g., LLC, Corporation, etc.).

- Enter your business's principal activity. Brief description makes it easier for tax assessors to understand your operations.

- Fill out the Business Start Date in Michigan, ensuring to follow the MM-DD-YYYY format.

- Include your NAICS code, ensuring it corresponds with the classification for your business activities.

- Proceed to fill out the Modified Gross Receipts Tax section, specifying all required income and expenses as outlined in the instructions. Pay close attention to the deductions you are eligible for.

- Continue to the Business Income Tax section if applicable, adding any additions or subtractions as directed on the form.

- Complete the Total Michigan Business Tax section, summarizing all calculated tax amounts.

- If making any payments, complete the Payments, Refundable Credits, and Tax Due section.

- Finally, review all the information entered for accuracy. Once confirmed, save the changes, download a copy of the completed form, print it, or share it, per your filing needs.

Complete your Annual Return (4567) form online today to ensure timely and accurate filing.

Most business entities are required to file tax returns at the federal level as well as the state level. If you have registered a company in Michigan then some form of business taxes may be applicable. Michigan Business Tax – Complete Guide | IncParadise incparadise.net https://incparadise.net › michigan › michigan-business-tax incparadise.net https://incparadise.net › michigan › michigan-business-tax

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.