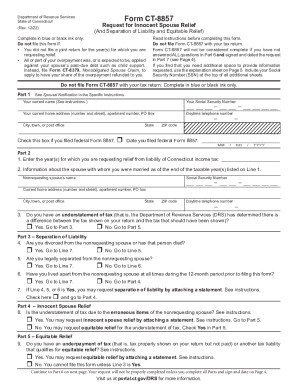

Get Separation Of Liability Reliefinternal Revenue Service

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out and sign a form online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:Have you been trying to find a quick and practical solution to complete Separation Of Liability ReliefInternal Revenue Service at a reasonable cost? Our platform provides you with an extensive variety of templates available for submitting on the internet. It takes only a couple of minutes.

Stick to these simple instructions to get Separation Of Liability ReliefInternal Revenue Service completely ready for sending:

- Choose the sample you require in our collection of legal templates.

- Open the form in the online editing tool.

- Read through the recommendations to determine which information you have to give.

- Choose the fillable fields and include the necessary information.

- Put the date and place your electronic autograph once you fill in all of the boxes.

- Double-check the completed form for misprints along with other errors. If there?s a necessity to change some information, the online editor and its wide range of instruments are available for you.

- Download the resulting template to your computer by clicking Done.

- Send the electronic document to the parties involved.

Submitting Separation Of Liability ReliefInternal Revenue Service does not have to be confusing anymore. From now on comfortably get through it from your home or at your business office right from your smartphone or PC.

Get form

What Is IRS Form 8379: Injured Spouse Allocation? The "injured" spouse on a jointly filed tax return can file Form 8379 to regain their share of a joint refund that was seized to pay a past-due obligation of the other spouse.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.