Loading

Get A Completed Tax Return (fp-7/c) Is Required To Record Any Deed, Deed Of Trust, Modification Or

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the A Completed Tax Return (FP-7/C) Is Required To Record Any Deed, Deed Of Trust, Modification Or online

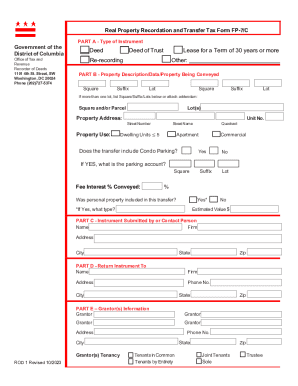

Filling out the A Completed Tax Return (FP-7/C) is an essential step in recording any real estate transaction like a deed or deed of trust. This guide provides clear and detailed instructions to help you complete the form online efficiently.

Follow the steps to accurately complete the tax return form.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- In Part A, check the box corresponding to the type of instrument being recorded, such as 'Deed' or 'Deed of Trust'.

- Complete Part B by entering the relevant property description details, including square, suffix, and lot numbers. You can find this information on the Real Property Services website.

- Indicate the property use by checking the appropriate box in Part B. Enter the percentage of interest being conveyed in the designated field.

- In Parts C and D, provide the contact information for the person submitting the instrument and where to return the instrument after processing.

- Enter the complete name and contact information of each Grantor and Grantee in Parts E and F. This will be important for receiving future tax notifications.

- If the billing address is different from the property address, complete Part G with the new mailing address.

- Fill out Part H with the necessary financial information. Provide the acquisition price, current tax year assessed value, and related details about any exemptions that may apply.

- For computation of tax in Part I, follow the instructions for calculating the recordation tax based on the type of property and consideration amounts.

- In Part J, list the names of all Grantors and Grantees, ensuring all required signatures are present. The signatures must be acknowledged and notarized.

- Once you have filled out all sections, save your changes and prepare to download, print, or share the completed form as necessary.

Start filling out your A Completed Tax Return (FP-7/C) online today to ensure your deed is recorded accurately.

The seller often pays the transfer tax and recordation tax is paid by the buyer, however this can be negotiated.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.