Loading

Get Dr 0104x 2023 Amended Individual Income Return Instructions. If You Are Using A Screen Reader Or

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the DR 0104X 2023 Amended Individual Income Return Instructions if you are using a screen reader online

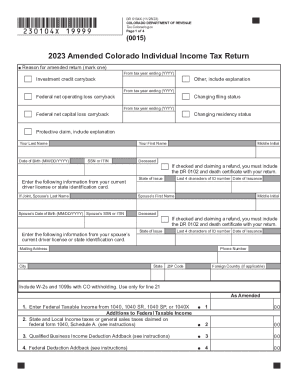

This guide provides a comprehensive overview of the DR 0104X 2023 Amended Individual Income Return Instructions, specifically tailored for users utilizing screen reading technology. By following the steps outlined, you will be able to accurately complete the amended return with clarity and confidence.

Follow the steps to effectively complete the DR 0104X form.

- Press the 'Get Form' button to access the DR 0104X 2023 Amended Individual Income Return. This will open the form in your chosen digital editor.

- Begin by entering your last name, first name, and middle initial in the designated fields. If applicable, include your and your spouse's date of birth, Social Security number (SSN) or Individual Taxpayer Identification Number (ITIN). If the taxpayer is deceased, check the appropriate box and prepare to submit the required documentation.

- Complete the mailing address section with your current address including city, state, and ZIP code. Include your phone number for any possible follow-up.

- For the Federal Taxable Income, enter the amount in line 1 as it appears on your original federal tax form.

- Proceed to fill in all applicable addition and subtraction lines as specified by the instructions. Make sure to submit any required documentation for each addition or subtraction noted.

- Complete the tax, prepayments, and credits sections. Ensure that any credits you are claiming are supported by the required forms.

- If you are requesting a refund or direct deposit, provide the necessary bank details for processing, including routing and account numbers.

- Review all entered information for accuracy. If satisfied, save your changes.

- After completing the form, you have the option to download, print, or share the amended return. If you opt to file electronically, follow the prompts provided by the digital filing platform.

Start the process of filing your amended return online today to ensure accuracy and efficiency.

It does not cost anything to fill in and mail a tax amendment.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.