Loading

Get Dr 0021w Colorado Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Dr 0021w Colorado Form online

Filling out the Dr 0021w Colorado Form online is a straightforward process that can be completed with ease. This guide will walk you through the necessary steps to ensure your form is filled out correctly and submitted properly.

Follow the steps to complete the Dr 0021w Colorado Form easily.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

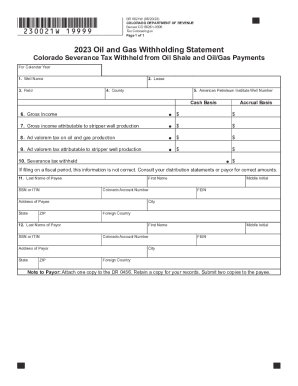

- In box 1, enter the well name associated with your oil and gas production. Ensure this is accurate as it identifies the specific site of production.

- In box 2, fill in the lease number. This number is vital as it relates to the legal rights for extracting resources from the land.

- In box 3, indicate the field in which the oil or gas is produced. This helps in categorizing the production area.

- For box 4, enter the county where the production takes place. This information is required for local tax assessments.

- In box 5, supply the American Petroleum Institute Well Number to further identify your specific well. This number is crucial for record-keeping.

- For line 6, enter the total gross income from your oil and gas production for both cash and accrual basis, as indicated.

- Line 7 requires you to specify the gross income attributable to stripper well production, again for both cash and accrual basis.

- On line 8, report the amount of ad valorem tax on oil and gas production for both cash and accrual basis.

- For line 9, enter the ad valorem tax related to stripper well production for both accounting methods.

- On line 10, document the severance tax that has been withheld and remitted to the Colorado Department of Revenue for the calendar year.

- In boxes 11 and 12, complete the required information for both the payee and payor, ensuring all details are correct.

- After filling out all sections, save your changes and download, print, or share the form as necessary.

Take the next step to complete your documentation by filling out the Dr 0021w online now.

OF FORM DR 21W Any producer, working, royalty or other interest owner of oil and gas produced in Colorado is required to pay severance tax. Every producer or first purchaser is required to withhold 2% of the gross income paid to every owner, and to supply an Oil and Gas withholding Statement by March 1 of each year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.