Loading

Get And Related Tax Exemptions - Union County Property Appraiser

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the And Related Tax Exemptions - Union County Property Appraiser online

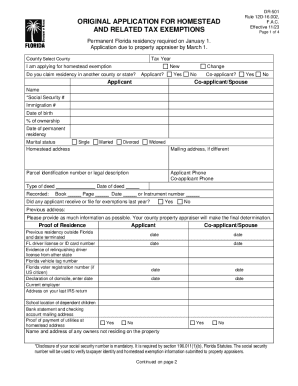

Completing the And Related Tax Exemptions form is an essential step for individuals seeking to apply for homestead exemptions in Union County. This guide will provide clear, step-by-step instructions to help users navigate the online process effectively.

Follow the steps to successfully complete your application.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Select the appropriate county and tax year from the provided options on the form. Ensure that this information is accurate, as it determines the application’s validity.

- Indicate whether you are applying for a new exemption or if you are making a change to an existing application. Choose 'Yes' or 'No' accordingly.

- Fill in the applicant's details, including name, social security number, immigration number, date of birth, percentage of ownership, and date of permanent residency.

- If applicable, provide information for the co-applicant or spouse. This includes their name, social security number, immigration number, date of birth, and ownership percentage.

- Enter the homestead address, mailing address (if different), parcel identification number, type of deed, and relevant recorded information such as the date of the deed and book/page number.

- Indicate whether any applicant received or filed for exemptions in the previous year, and provide the previous address if applicable.

- Provide proof of residence. Include details such as Florida driver license number, vehicle tag number, voter registration number, current employer, and mailing address for bank statements.

- Choose any additional exemptions for which you are applying, such as benefits for age, disability, or veteran status, and complete any required information associated with those exemptions.

- Review the authorization statement and ensure it is accurately filled out. This includes certifying the truth of the information provided on the form.

- Sign the application, enter the dates, and ensure the co-applicant has done the same if applicable.

- Submit the completed application to the county property appraiser. You may choose to save changes, download, print, or share the form as needed.

Start your application process online today and secure your homestead tax exemptions!

Both of these amounts are taxable. Line 4: Enter income from any other sources not included above (income reported on Form(s) 1099-MISC, self-employment income, business income). Do NOT include any Social Security benefits as they are not taxable in Ohio.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.