Loading

Get Arizona Form A1 R 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Arizona Form A1 R 2022 online

Completing the Arizona Form A1 R 2022 online can be a straightforward process when you follow the proper guidance. This step-by-step guide will help you understand each section of the form and provide you with the necessary instructions to ensure accurate submission.

Follow the steps to complete the Arizona Form A1 R 2022 online successfully.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

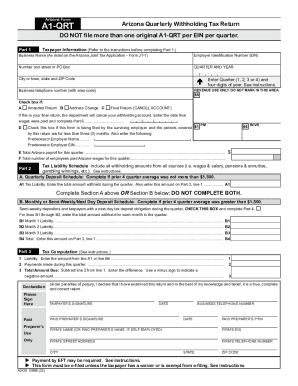

- Begin by completing the taxpayer information in Part 1, which includes entering your business name, Employer Identification Number (EIN), and address. The city, state, and ZIP Code must also be filled in accurately.

- Indicate the quarter and year for which you are filing by entering the quarter number (1, 2, 3, or 4) and the four digits of the year.

- Choose any relevant checkboxes in Part 1, such as whether this is an amended return, an address change, or a final return. Make sure to provide the date final wages were paid if applicable.

- In Part 2, determine and complete the tax liability schedule by entering the total amount of withholding for the quarter. Specify if you need to complete the quarterly or monthly/semi-weekly deposit schedule.

- Proceed to Part 3 where you compute your tax liability by entering the total from Part 2. Then, include any payments made during the quarter to calculate the total amount due.

- After filling out your financial information, locate the declaration section. Ensure that a taxpayer or paid preparer signs the form, including the date and business telephone number.

- Once all fields are correctly filled, review the entirety of the form for accuracy. Users can then save the changes, download, print or share the completed form as needed.

Take the necessary steps today to complete and file your Arizona Form A1 R 2022 online!

The new default Arizona withholding rate is 2.0%. What if the employee wants their Arizona taxes to be overwithheld? Employees will still have the option of selecting a higher Arizona withholding rate than their wages might dictate and there is still a line to add an additional amount of Arizona withholding.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.