Get Ca Calstrs Es 1161 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA CALSTRS ES 1161 online

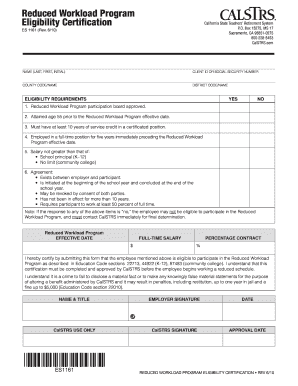

Filling out the CA CALSTRS ES 1161 form is an essential step for educators looking to participate in the Reduced Workload Program. This guide will provide you with clear, step-by-step instructions to ensure that the process is straightforward and accessible.

Follow the steps to successfully complete your form

- Use the 'Get Form' button to access the CA CALSTRS ES 1161 form and open it in your preferred editor.

- Begin by filling out the *name* section with the last name, first name, and middle initial of the individual applying.

- Review the eligibility requirements listed under 'Eligibility Requirements.' Indicate 'yes' or 'no' for each requirement to confirm the individual's eligibility.

- In the section titled 'Reduced Workload Program Effective Date,' input the official start date for the reduced workload.

- Certify the information by providing the name and title of the employer representative signing off on the application.

- Leave the 'CalSTRS Signature' and 'Approval Date' sections blank, as these will be completed by CalSTRS upon review.

- Once all required fields are filled out, ensure to review the form for accuracy before saving your changes, downloading, printing, or sharing it.

Complete the CA CALSTRS ES 1161 form online today to begin your participation in the Reduced Workload Program.

Get form

Yes, you can work after retiring from CalSTRS, but there are specific regulations regarding how much you can earn without affecting your retirement benefits. This arrangement can help you ease into retirement while still maintaining an income stream. However, you should be cautious of any earnings limits to ensure your pension remains intact. The guidelines provided under CA CALSTRS ES 1161 detail the processes you need to follow and the implications of returning to work.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.