Loading

Get Marketplace Facilitator Certificate Of Collection

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Marketplace Facilitator Certificate Of Collection online

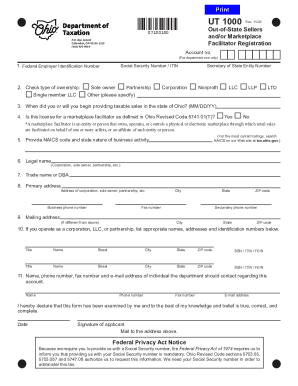

Filling out the Marketplace Facilitator Certificate Of Collection is an essential step for out-of-state sellers and marketplace facilitators operating in Ohio. This guide will provide you with a clear and user-friendly approach to completing the form accurately and efficiently.

Follow the steps to complete the form with ease.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your Federal Employer Identification Number or Social Security Number/ITIN in the appropriate field. This information is crucial as it uniquely identifies your business for tax purposes.

- Select the type of ownership from the options provided: single member LLC, sole owner, partnership, corporation, nonprofit, LLC, LLP, or LTD. Be sure to choose the option that accurately reflects your business structure.

- Indicate the date you began or will begin providing taxable sales in Ohio, using the format MM/DD/YY. This date is essential for the state’s records.

- Answer the question regarding whether the license is for a marketplace facilitator by checking 'Yes' or 'No.' Understanding the definition provided will help you determine the correct response.

- Provide the NAICS code along with a brief description of your business activity. This information classifies your business for statistical purposes.

- Fill in your legal name as required, whether you are a corporation, sole owner, or in partnership. This should match your official business documents.

- Enter your trade name or Doing Business As (DBA) if applicable. This is the name under which your business operates.

- Input your primary address, including the street address, city, state, ZIP code, and business phone number. Ensure all details are accurate for effective communication.

- If your business operates as a corporation, LLC, or partnership, provide the names, addresses, and identification numbers of relevant individuals. This section is crucial for identifying stakeholders.

- List the name, phone number, fax number, and email address of the individual to be contacted regarding this account. This ensures the department can reach the appropriate person for any inquiries.

- Declare that the information provided is true, correct, and complete by signing and dating the form. This final step confirms your commitment to providing accurate information.

- Once you have filled out the entire form, you can save your changes, download, print, or share the form as necessary.

Complete your Marketplace Facilitator Certificate Of Collection online today for a seamless experience!

California Adopts New Regulations to Clarify Marketplace Facilitator Responsibilities. Effective 8/28/2023, California has added additional language to its Code of Regulations to clarify which businesses have responsibilities under their marketplace facilitator laws.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.