Loading

Get Mi Lw-3 - City Of Lansing 2013-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI LW-3 - City Of Lansing online

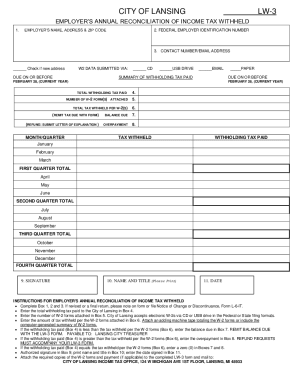

Filling out the MI LW-3 form for the City of Lansing is an essential process for employers to reconcile income tax withheld. This guide provides detailed, step-by-step instructions to help users navigate the online form efficiently.

Follow the steps to complete the MI LW-3 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the first section, provide the employer's name, address, and ZIP code. This information is crucial for the tax office to identify your submission accurately.

- Enter the federal employer identification number in the designated field. This unique number identifies your business for tax purposes.

- Include a contact number and email address to ensure that the tax office can reach you regarding any inquiries.

- Indicate if there is a new address by checking the appropriate box if applicable.

- Specify how W2 data was submitted (e.g., CD, USB drive, email). Ensure that you mark the correct option.

- Enter the total withholding tax paid in the summary section. This provides an overview of the total taxes remitted.

- State the number of W-2 forms attached. Ensure that these forms are provided as needed.

- Enter the total tax withheld according to the W-2 forms attached.

- If the total withholding tax paid is less than the amount withheld, calculate and enter the balance due.

- If overpayment exists, document the overpayment amount and provide a letter of explanation.

- Fill out the quarterly tax withheld section, entering the relevant amounts for each month.

- Provide your signature in the signature box and print your name and title in the specified fields.

- Finally, input the date of submission at the end of the form, check for accuracy, and ensure all necessary attachments are included.

- Once completed, users can save changes, download, print, or share the form as needed.

Begin completing your MI LW-3 online today to ensure compliance and streamline your tax process.

If you are a Detroit resident, all of your income is subject to Detroit tax, no matter where it is earned. See line-by-line Instructions for Form 5118, 2021 City of Detroit Resident Income Tax Return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.