Loading

Get Repayments: Where To Send Claim Forms - Gov.uk

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Repayments: Where To Send Claim Forms - GOV.UK online

This guide provides an expert approach to filling out the Repayments: Where To Send Claim Forms - GOV.UK online. It simplifies the process into clear, actionable steps to ensure that users can complete the form accurately and efficiently, regardless of their experience with legal documents.

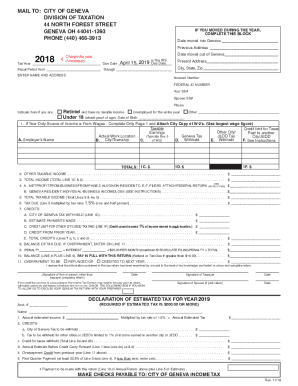

Follow the steps to accurately complete your claim form.

- Press the ‘Get Form’ button to access the claim form and open it in your preferred editor.

- Begin by filling in your personal information in the designated fields, including your name, address, and contact information. Make sure all information is current to avoid any processing delays.

- If you have moved during the year, complete the section asking for your previous address and the date of your move. This is vital for accurate tax processing.

- Identify your tax year and ensure that the due date is correctly stated. This helps in determining your deadline for submission.

- Indicate your account number and federal identification number in the appropriate fields. If applicable, provide your social security number and your spouse's if it is a joint return.

- Complete the income section by detailing your income sources. If your only income source is wages, complete only the page required for this information and attach the city copy of your W-2 forms.

- Fill out the details relevant to your employment including the actual work location and the employer's name, taxable earnings, and any taxes withheld.

- If applicable, complete the section for other taxable income, adding it to your total income calculation.

- Review the tax calculations to ensure you are applying the correct tax rates to your total taxable income, making note of any deductions or credits you may be eligible for.

- Complete the balance due or overpayment section as necessary, ensuring that all calculations are clearly stated.

- Finally, review the document for accuracy, provide your signature, and date it appropriately. If a tax preparer was used, include their information as required.

- Once all sections are filled out, you can save your changes, download a copy for your records, print the form, or share it as needed.

Complete your claim forms online today for an efficient processing experience.

If you made a mistake in your tax return, and paid too much tax, but only realise after the deadline for amending the tax return has passed, you may still be able to claim a repayment of overpaid tax. This is called overpayment relief. In this situation you will need to write to HMRC and tell them about your mistake.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.