Loading

Get Wi Dor W-ra 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WI DoR W-RA online

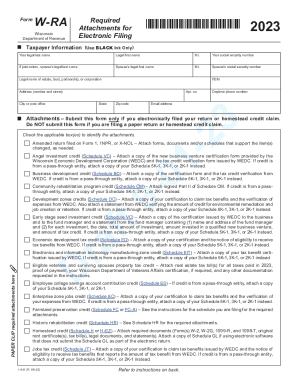

The WI DoR W-RA form is essential for submitting supporting documentation when electronically filing income or franchise tax returns in Wisconsin. This guide will provide you with an easy-to-follow process to complete the form accurately.

Follow the steps to effectively fill out the WI DoR W-RA online.

- Press the ‘Get Form’ button to access the WI DoR W-RA form and open it for editing.

- Provide the legal name of your estate, trust, partnership, or corporation if applicable, along with the Federal Employer Identification Number (FEIN).

- In the attachments section, select the applicable boxes that correspond to the documents you are submitting. Ensure you only submit this form if you have electronically filed your return or homestead credit claim.

- Once you have filled out all sections, save your changes. Ensure all required attachments are included and organized. You may then download, print, or share your completed form as needed.

Complete your WI DoR W-RA form and any required documents online today for efficient processing!

You can find your current balance due online if you have set up online access to our portal. The part of the portal where you can check your current balance is the billing detail section. If you do not have access to our online portal, please contact our office at (608) 261-6700 to be sent an access key.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.